Show Notes – 10/5/2023

- CNI Quick News Recap

- Heartfelt wishes for those impacted and moving on. If you’re looking for talent, there are some great opportunities here to get talent..

- QUICK Recap the of IPO issues leading to current market

- Credit Suisse failed and folded into UBS and the failure of finding new underwriter early enough

- UBS cut several of the existing businesses Credit Suisse was involved with, and tech underwriting got hit hard.

- But I am not clear if this was related to Chia only or all of the Credit Suisse Tech Underwriting IPO Cohort.

- Exchange Market Watch, the panic sell on HTX (Huboi) and current $XCH Price Watch

- Sale of Prefarm by Chia Inc

- Estimate 850K – 1.2M needed per month for HC + Overhead

- So much of this is based on transaction volume on HTX (Huboi) Exchange which has calmed down now

- Impact on IPO prospects

- Chia Inc is not as risk free as it once was in my eyes

- Hard market to land an IPO possibly in current market state

- Honestly I would be most optimistic to see the IPO landing in a general crypto bull market, not a bear market.

- Belt and Suspender rules for sales of securities

- Framework allows for either under 5M or under 10M in sales in a 12 month period but secondary sales can be impacted

- Restrictions on solicitations for sales of those assets are complex, but manageable

- I am not a lawyer and have no idea so probably wrong here as well

- Unknown what or if there will be a SEC reaction

- Impact on price

- If OTC (would seem most likely, but also hard environment and above structuring)

- If Market sales (Yikes, super unlikely)

- Price floor has not breached 20/XCH. That is GREAT news I think.

- Feasibility for getting a series E from late stage investors seemed pretty low from interview

- How I am Approaching myself presented for Current Farmers

- I need to be able to have more accurate, and quickly referenceable, current state but various $XCH price models pre and post halving

- So I created a sheet to provide clearer and more precise variables

- Chia Farming Profitability Calculator

- Show how to make a copy for their own use, NO EDIT ACCESS

- Show how to input fields with my own numbers

- Show price breaks and talk about halving and fixed OPEX impact on a chia farm at low prices

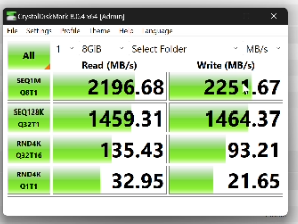

- Evaluate my farm wattage efficiency

- My god the AC is killing me

- Freaking RAID is also killing me, but easy solve

- Replotting to max out C space once GH 2 lands which is super soon

- Focus on stacking…. or swapping??

- Replotting AGAIN to possibly OG or super low C plots at/directly after halving if no price increase

- Focus on efficiency. OG Higher K plots start to look attractive again.

- Diversify some storage space out to other HDD based cryptos immediately

- FIL, Subspace, SCprime, Spacemesh

- All this sheet does is current state analysis. That assumes the price is fixed and it certainly is NOT fixed.

- What can you improve efficiency on with your farm? Get those lists going now!

- What is your electric rate?

- Don’t forget to include all the delivery fees, taxes, meter charge and other added items that they add in

- We need to see the price of XCH move before the halving to stay viable for many farmers

- This includes farmers with even lower electric rates

- Farmers that have higher base electric rates have higher fixed OPEX costs

- Farming that requires additional A/C is NGMI post halving unless something flips on big (summer farmers in TX???)

- Exploring outdoor drafting again for non-humid times of year

- I need to be able to have more accurate, and quickly referenceable, current state but various $XCH price models pre and post halving

- What it might mean for FUTURE farmers

- Expansion is hard to get the math to work out unless you can get some hardware super cheap.

- Math first! ROI is hard to envision. If you are going to ask “WEN ROI” do that math now.

- Potential Points of Optimism

- How important is the IPO being soon to you, a Chia farmer? I think CNI running a solid services business is important to long term growth and success and them having a clear path to an IPO that is successful comes from that.

- As farmers leave or rescale plots for efficiency we could see decreased netspace but most likely that hits as any decrease closer to halving. Current Chia farmers likely to stay running on what they have as long as positive.

- Finance restructure hopefully happened with enough time for next several quarters or year runway at least

- Eth bridge is “soon”. Can this ease ingress and egress? IDK.

- Gene has talked about banking partners and they could REALLY use an announcement on some front to bolster their cred to the general community. We get that there is big, long plays. Is that all of them however? Some partner should be willing to be named early in their project.

- Gene has said in the past he doesn’t focus much on the price of XCH, but with the sale of some portions of the prefarm that may change. Mutually aligned interests are good IMO

- The price just hit new ATL’s but is overall not on a divebomb run currently. NOT FINANCIAL ADVICE but I think the scare part of the news has been absorbed.

- Chia’s Business Plan has been put into action and they have mitigation in play for this scenario of cash shortfall, kind of.

- Chia has always been less about crypto and more about creating foundational technologies. In this, they have done amazing.

- Chia STILL is a very low cost crypto to operate no matter what. The cost to leave a farm running even if in the negative are rather low and there is potential to hit large diff swings and rewards.

- Still an amazing tech stack for a decentralized cryptocurrency

- Crypto doesn’t have to make sense to boom. It’s still wild out there

- Potential Points of Pessimism

- The impact of the halving will be significant on farmer OPEX unless there is some signifigant price movement.

- Sell price pressure on XCH is not good.

- I’m not sure what changes that specifically.

- Hard to enter and exit eco still (LBank, Simpleswap, ETH bridge)

- The future of Chia the company has a higher risk profile now

- Chia needs to be the guiding force behind the blockchain currently as its too complex to develop all the things

- Compression advancements and GPU advancements are always just one very smart person away from a revolution in the PoST ecosystem

- They have runway, but do they have enough runway?

- OPEX fixed costs are very impactful at sub 30 prices. Would be much less of an issue sub-30 pre halving.

- The history of crypto mining projects turning back can take a long time. This bear market may not be nearing an end.

- Not all projects recover in crypto. Failure is always an option, even if its not what we want.