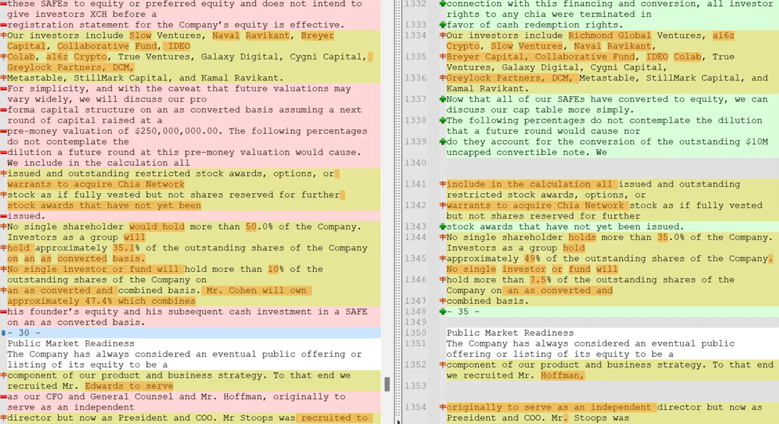

I took the opportunity to read the newest Chia Whitepaper in a different context than a lot of folks might consume a whitepaper. I use my favorite text editor to compare the differences between the newest and prior whitepapers. Let’s dive into what I found!

https://www.chia.net/2022/02/02/chia-business-whitepaper-2.0.en.html

If you want to follow along by line numbers, download Notepad++ and paste in the text from the PDF.

Line 118: Talking about Non-OECD and smaller OECD countries as who they envision as partners for early adoption. I think this is a good refinement message.

Line 142: Chia has moved the Market Overview section up higher which I think presents better to align their market perceptions to what they will be targeting and seeing as potential customers and adopters first.

Line 296: Company Vision. This provides a great line of thought for how they are thinking about what Chia brings to the table.

Line 336: Headcount Changes. Chia has increased the engineering and biz dev headcount in significant ways.

Line 390: Clarifications on what it would take for a successful attack clarification. TLDR its about 15EiB of storage along with the fastest timelord…good luck.

Line 396: Specificity about block times being 52 seconds vs the prior mentioned range.

Maybe you would prefer a video of this instead? I have you covered 😉

Lines 558-590: Chia and CAT from a current end user perspective is probably majorly different than how Chia Official looks at the capabilities and future and uses for CAT from a “sellable/serviceable” revenue generating perspective. It is more potential with the capabilities from what we have seen currently.

Line 702: Layer 2 techs and ZK Rollups are something on the horizon. This will speed up transactions, extend capabilities and lower TX fees.

Line 882: A big one! Chia has converted the SAFE agreements that many people talked with much FUD into Preferred Equity. This takes the talking point of “investors can demand XCH” off the table. Very good news!

Line 930: Clarification on certain tests for a SEC and a potential listing and why they are not paying anyone in XCH. This is staying on the safest side possible.

Line 1002: CAT’s rule.

Line 1035: Chia and Carbon Markets strategy has much more definition and outline.

Line 1329: Chia is at a Series D funding round at their last round. I had prior speculated Series A, but this a sign imho that they are much closer to a potential IPO.

Check out my article on my Call for Clarity from Chia CAT based projects